The environment which your business sits is called the industry. Every business (no matter the size) needs to have knowledge of their surrounding environment so that they can effectively react, and not get beaten by the competition in any given market.

What is Industry analysis definition? Industry analysis is the process of researching and monitoring the environment your business is located in. This includes both Internal and External assessments of the industry, that ensures you are abiding by the Political, Social, Economical and Technological Landscape, for your business to remain profitable and competitive under these constraints.

The good news is that you can easily monitor this with our easy industry analysis guide. In this article, I will show you the best tools that will bring detailed insight of your industry.

1. What is Industry Analysis?

Before, we go through the #7 tools I will explain more about what the industry analysis is. Industry analysis is the terminology we use to assess the competitive dynamics of any given market. Industry assessment helps to understand the demand in the market, and the state of competition.

You want to gather this knowledge to understand whether it is feasible for you to enter into the new market, or be more competitive in the existing market. .

There are so many ways marketers and strategists organise their industry assessments. For example, some marketers just include competitors in their analysis, whilst others include a whole heap of factors altogether. This really depends on the type of market you are in, and the size of your business. For example, if you are a global business, you will require a more detailed assessment (meaning more information is required), whilst a small business may only really need to know about the competition and social factors in the target market.

To that end, industry analysis answers one crucial question… Does our business have the right resources to deliver the value that is necessary to our customers and still make a profit, under the constraints of the surrounding environment?

This means there are two parts to an industry analysis. The first part evaluates the environment, which is called external analysis. The second part evaluates your capabilities and resources, which is called the internal analysis.

1.1 External Analysis

An external analysis looks at the wider business environment that affects your business. This industry assessment covers all the factors that are outside of your control.

This includes both the micro and macro environmental factors.

Macro environment

Macro environmental factors include governmental laws, social construct and cultural norms, environmental conditions, economic, and technology.

Micro environment

Micro environmental factors include the rivalry of the competition.

1.2 Internal analysis

An internal analysis is assessing your business’s competency to deliver the intended value to your customers.

It suggests your competitive viability in the marketplace.

This industry assessment includes culture, resources, value chain, and SWOT analysis.

2. Why is Industry Analysis Important?

It is important to understand the competitive landscape before trying to enter a market because it gives you a better idea of what to expect when you enter that market. Whilst establishing potential opportunities and threats for predicting the future scenario of the industry.

The industry is constantly changing, and so it also important for all businesses to assess and reassess your market position relative to others in the industry. The information gathered helps gain insight into your positioning strategy.

Overall, it gives you a better chance of competing by which your brand reputation, costs and time are at risk.

3. PESTLE Analysis [Tool #1]

The PESTLE tool provides the key drivers to help focus on what is important within the macro environment. PESTLE categories environmental influences into SIX types: Political, economic, social, technological, environmental and legal.

Furthermore, politics highlights the role of governments. Whilst economics refers to exchange rates, business cycles and economic growth rates. Where as, social includes changing cultures and demographics (such as the baby boom). Technological cultures include innovations such as the internet or self-service. Environmental stands for green issues such as pollution and waste, and legal embraces legislation constraints such as health and safety.

4. Porter’s Five Forces [Tool #2]

This is a tool used to establish competition and know the competitive strength in the market.

4.1 Porters Five Forces Model

Porter’s five forces is a model used to establish who the competition is (Porter, M. E., & Millar, V. E, 1985).

Threat of new entry – The first phase of the porters five forces model is to establish who the new entrants are. Work out who else may consider entering the market that could disrupt our plan.

Supplier Power – who are the suppliers and who do these people dominate the supply. The supplier power can be broken into first factors.

The first is to measure the switching costs.

The second is to measure how much of the market do they dominate.

Threat of Substitutes – who the substitutes are and what is the chance people could switch products.

Buying power – how much variation do they buyer have access too. What are the switch costs and how many buyers are in that market.

4.2 Competitive Rivalry

Four of the five forces assess the rivalry the all the elements that make up an industry.

The fifth force is the competitive rivalry and this impinges the direct competition between your business and the immediate rivals.

The phase is to establish the strength all the elements has in the market.

The aim here is to establish how influential the suppliers, substitutes, buyer and new entrants are in the market as this will dictate the positioning strategy.

In terms of substitute’s competitor are direct and indirect.

Direct competitors are those companies that deliver the same or similar product as your company.

Indirect competitors are also a major concern.

If we take a look at the collapse of blockbusters, evidently it was a result of both the indirect competition and direct competition that destroyed their business model. However, it was the indirect that they were unaware of.

Overall, it is harder for businesses to see beyond the direction competition as these business could occupy a infinite amount of space in the competitive landscape.

In addition, Netflix delivered to the same needs of blockbuster’s customers with a very different product.

This in turn further outlines the barrier to enter a new market.

Low barrier to entry mean a market is attractive for your business and high barrier to entry mean your business should be careful if going into that market.

5. Industry Life Cycle [Tool #3]

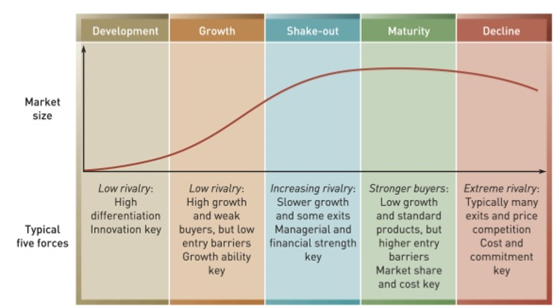

The industry life cycle depicts the likelihood of how an industry will act over time.

If a product is new to a market, if it is viable at first you will see small and steady growth.

As time goes on and people begin to see how useful this product is, then it will result in boom.

However, this boom can only last for so long before it starts to mature and then slowly decline.

When conducting an industry analysis it is useful to understand which phase your business will enter.

If you enter at the mature stage then it can be risky, and you will need to have to innovate this already known idea to push revenue and start the cycle over again.

5.1 Industry Life Cycle Model

Sometimes, industries are essential to join as the length of the phases could be tens of years.

For example, the internet is an industry that has continued to grow since it was first created and we are probably still in the growth/shakeout stage.

By not having a website your business is potentially dead.

6. Blue Ocean Strategy [Tool #4]

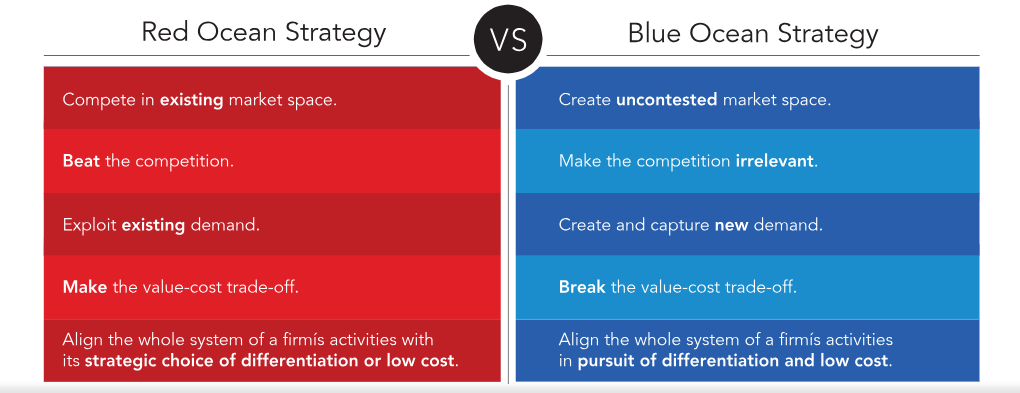

Blue oceans are looking for the new market spaces that competition is minimised.

Furthermore, blue ocean thinking is looking for those spaces and envisions what space you are in based from the porter’s five forces.

6.1 Blue Ocean Thinking

Avoid red ocean where possible as if your new to a market you will probably get eaten up by the competition.

7. Resources and Competences [Tool #5]

Resources are the assets that a business has or can call upon.

Competencies are the effectiveness of those assets being deployed.

In other words, resources is what we have whilst competencies is what we do well.

Being able to utilise the resources is more important that having the resources when competing in a market.

8. VRIN [Tool #6]

This a is a tool we use to assess our resources and capabilities.

In addition it means Value, Rarity, Inimitability and non-substitutability.

Value: do capabilities exist that are responsible for deliver more value that provide us a competitive advantage.

Rarity: do our capabilities exist in the market already, or are they rare?

Inimitability: are our capabilities easy for our competitors to imitate?

This includes value chain, causal ambiguity, culture & history and change.

None-substitutability: what is the risk of using a substitute product?

9. SWOT Analysis [Tool #7]

The last thing you need to do in your industrial analysis is write an SWOT analysis.

This is used to summarise the key issues that arise from all your industry assessment and analysis.

It summaries strengths, weaknesses, opportunities and threats likely to impact the strategic direction.

9.1 SWOT Analysis Model

The SWOT is a strategic review of a business position. It is an analysis assumes all key business factors have been taken into consideration.

Conclusion

In this post, we have gone over all the overarching factors that need to be considered to perform a detailed industry analysis.

The industry analysis is summarised by SWOT analysis and is used to justify whether or not to enter a new market.

The factors such as internal to the business operation and external of the business control need to be closely looked at before moving forward.

Overall, this makes more sense to do it this way because everything from how the organisation is structure, competition and governmental laws, all shape how our business delivers value to the customers.

This industry assessment tells us how competitors are currently delivering value.

However, I do not include market research under the term of industry analysis because market research provides us with the information of the value (not how to deliver the value).

Porters five forces is a tool used assess what the competition is in the industry and how vigorous is this competition.

Industry life cycle is also another good toll used the potential of a market.

Blue ocean thinking is a good tool to accurately demonstrate the viability of an existing market and outline potential new markets.